Unveiling the Stability of Financial Planning with Fixed Annuities

In the realm of financial instruments, “Fixed Annuities” emerge as a steadfast pillar, offering individuals a secure and predictable path towards financial stability. This unique form of annuity provides a fixed and guaranteed stream of income, making it an appealing option for those seeking reliability in an ever-changing economic landscape.

Understanding Fixed Annuities:

Fixed annuities are a form of insurance contract where individuals make a lump-sum payment to an insurance company in exchange for a guaranteed stream of income. What sets fixed annuities apart is the assurance of a fixed interest rate for a predetermined period, providing a level of predictability that appeals to conservative investors and those looking for a stable income in retirement.

Stability Through Fixed Interest Rates:

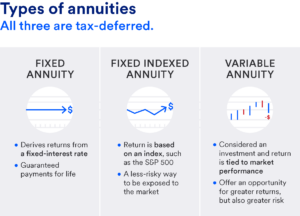

The primary appeal of fixed annuities lies in their fixed interest rates. Unlike variable annuities linked to market performance, the interest rate on fixed annuities remains constant throughout the specified period. This stability shields investors from market volatility, offering a reliable income source without the anxieties associated with fluctuating interest rates.

Guaranteed Income for Retirement:

Fixed annuities play a pivotal role in retirement planning by offering a guaranteed income stream. This feature is particularly attractive for retirees who prioritize financial security and desire a predictable source of funds to cover living expenses. The fixed nature of these annuities ensures that individuals can plan their budgets with confidence, knowing the exact amount they will receive regularly.

Tax Advantages of Fixed Annuities:

Beyond the stability they provide, fixed annuities offer potential tax advantages. While the interest earned is generally taxable, the tax liability is deferred until withdrawals begin. This tax-deferred growth can be advantageous for individuals seeking to optimize their tax strategy in retirement.

Flexibility in Payout Options:

Fixed annuities also provide flexibility in terms of payout options. Individuals can choose between receiving a fixed monthly income, quarterly payments, or an annual lump sum. This adaptability allows investors to tailor their annuity to suit their unique financial goals and lifestyle preferences.

Considerations for Fixed Annuity Investors:

While fixed annuities offer numerous benefits, investors should be aware of certain considerations. The fixed interest rate, while providing stability, may not keep pace with inflation over the long term. Additionally, the surrender charges associated with early withdrawals should be understood, as accessing the lump sum before the end of the specified period may result in penalties.

Comparing Fixed Annuities to Other Options:

In the landscape of financial instruments, it’s essential to compare fixed annuities to other investment options. Whether juxtaposed against variable annuities, certificates of deposit (CDs), or other fixed-income instruments, understanding how fixed annuities fit into a comprehensive financial strategy empowers investors to make informed decisions aligned with their objectives.

Conclusion:

In conclusion, fixed annuities emerge as a beacon of stability in financial planning, offering individuals a reliable income stream with fixed interest rates. This financial instrument proves especially beneficial for those prioritizing predictability and security, particularly in the context of retirement planning. While considerations such as tax advantages and flexibility enhance the appeal of fixed annuities, investors should conduct thorough research and seek professional advice to ensure alignment with their unique financial goals. With the stability and guaranteed income that fixed annuities provide, investors can navigate the complexities of financial planning with confidence.