Navigating Financial Dynamics with Variable Annuities: A Comprehensive Guide

In the dynamic landscape of financial planning, “Variable Annuities” emerge as a versatile option, offering investors a unique blend of flexibility and growth potential. These financial instruments provide individuals with the opportunity to participate in the market’s performance while still enjoying the benefits of an annuity structure.

Understanding Variable Annuities:

Variable annuities are insurance contracts that allow individuals to invest in a variety of sub-accounts, which are essentially mutual funds within the annuity. The distinguishing feature of variable annuities is that the returns are tied to the performance of these sub-accounts, providing a variable income stream based on market fluctuations.

Market-Linked Growth:

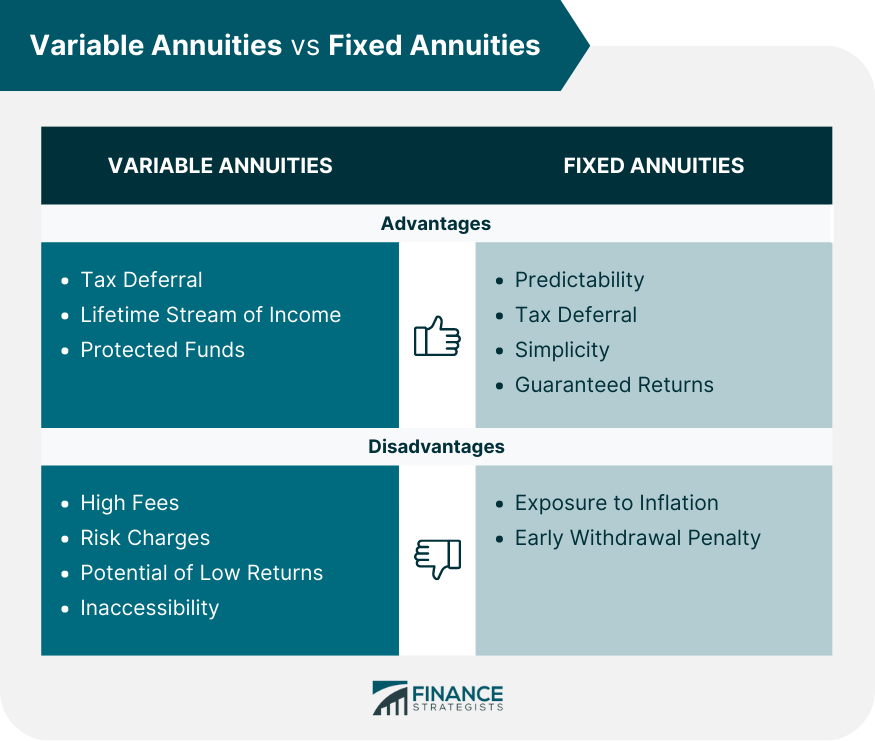

The primary appeal of variable annuities lies in the potential for market-linked growth. Unlike fixed annuities that offer a predetermined interest rate, variable annuities allow investors to benefit from the market’s upswings, potentially resulting in higher returns. This growth potential is particularly attractive for individuals willing to assume some level of investment risk in pursuit of increased yields.

Flexibility in Investment Choices:

Variable annuities offer a level of flexibility not commonly found in other annuity types. Investors can allocate their funds among various sub-accounts, typically consisting of stocks, bonds, and other investment options. This flexibility allows individuals to tailor their investment strategy to align with their risk tolerance, financial goals, and market outlook.

Variable Annuities and Tax Deferral:

One notable advantage of variable annuities is the ability to defer taxes on investment gains until withdrawals are made. This tax-deferred growth can be advantageous for individuals seeking to maximize their returns over the long term. However, it’s essential to understand the tax implications and potential penalties associated with early withdrawals.

Income Options and Guaranteed Minimums:

While variable annuities offer the potential for market-driven growth, they also provide income options. Investors can choose to receive a guaranteed minimum income, even if the market performance is less than anticipated. This feature acts as a safety net, offering a level of security in the face of market uncertainties.

Considerations and Risks:

Despite their appeal, variable annuities come with certain considerations and risks. Market volatility can impact the performance of sub-accounts, potentially affecting the overall value of the annuity. Additionally, fees associated with variable annuities, including management fees and mortality and expense fees, should be carefully examined to understand their impact on returns.

Comparing Variable Annuities to Other Options:

In the broader context of financial planning, investors should compare variable annuities to other investment options. Whether juxtaposed against fixed annuities, mutual funds, or other retirement vehicles, understanding how variable annuities fit into a comprehensive financial strategy is essential for making informed decisions.

The Role of Professional Advice:

Given the complexities and potential risks associated with variable annuities, seeking professional financial advice is paramount. Financial advisors can assist investors in assessing their risk tolerance, understanding the intricacies of variable annuities, and aligning their investment strategy with their broader financial goals.

Conclusion:

In conclusion, variable annuities offer a dynamic approach to financial planning, combining market-linked growth potential with the structure of an annuity. The flexibility in investment choices, tax deferral benefits, and income options make variable annuities an intriguing option for those willing to navigate the complexities of the market. However, careful consideration of risks, fees, and alignment with individual financial objectives is crucial. With the right guidance, investors can leverage variable annuities to create a well-rounded and adaptable strategy for long-term financial success.